According to Allied Market Research, the global hematology analyzer market size is $1,962.4 million in 2020, accounting for 5% of the total IVD market. It is expected to reach USD 3,941.1 million by 2030. growing at a CAGR of 7.30% from 2021 to 2030.

Rising prevalence of blood disorders such as anemia, blood cancers, bleeding disorders, and blood infections are the major factors driving the market growth. In addition, technological advancements in hematology analyzers, growing demand for automated hematology analyzers, and increasing preference for high sensitivity hematology analyzers are further driving the growth of the hematology analyzer market.

However, the high cost of hematology analyzers due to advanced features and automation and also facing stringent regulations may restrict the growth of the market. In contrast, growth opportunities in emerging economies are expected to offer higher profitability to the players in the hematology analyzer market.

Since the COVID-19 pandemic, research institutes have found that many hospitals have started using hematology analyzers to test and monitor COVID-19 patients. In response to the large population for effective COVID-19 screening, some regions are performing laboratory tests including white blood cells (WBC) and C-reactive protein (CRP) for early monitoring of the infection.

1. By product and service into instruments, reagents and consumables, and services

On the basis of product type perspective, reagents and consumables are the major segment of the hematology analyzer market. The reasons include adoption of reagents and consumables by clinical laboratories for blood cell counts, coagulation tests, other hematology tests, controls, and calibrations.

▲ Hematology Analyzer Market - By Product and Service

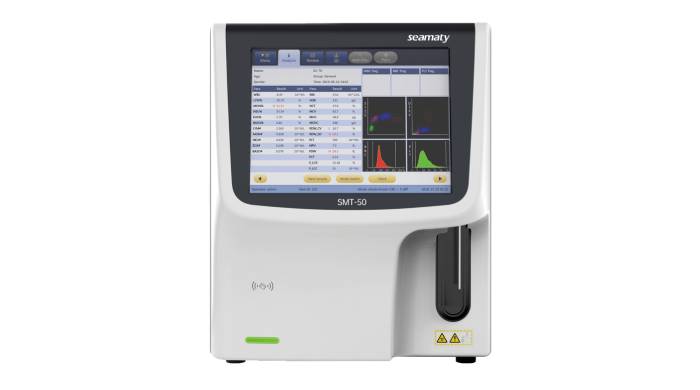

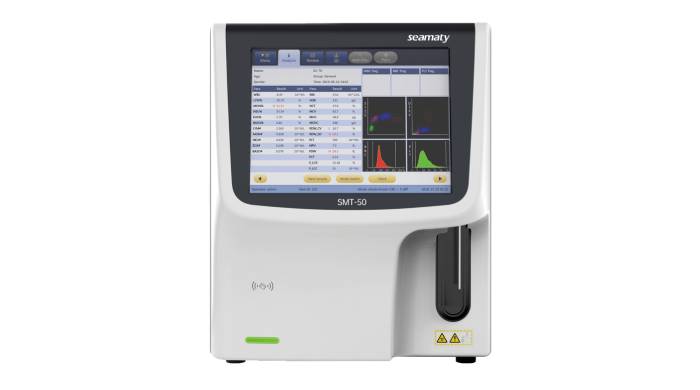

2. By type into fully automated hematology analyzers and semi-automated hematology analyzers

The fully automated hematology analyzer segment dominated the global market by product type perspective in 2020 and is expected to continue this trend during the forecast period. This is attributed to the growing preference for automated hematology instruments and the increase in technological advancements and the combination of basic flow cytometry technology in automated hematology analyzers.

▲ Hematology Analyzer Market - By Type

3. On the basis of end-user

End users are classified into hospitals, clinical laboratories, research institutes, etc., and also include including blood banks and biopharmaceutical companies.

From the end-user perspective, the clinical laboratory segment accounts for the largest share. Due to the need for high quality equipment in clinical laboratories and the accurate results obtained from it. It is expected to remain dominant throughout the forecast period. Moreover, the convenience of clinical laboratories and accurate results are the two major reasons driving the growth of the segment during the forecast period.

4. From a regional perspective

The market is analyzed across North America, Europe, Asia Pacific, and Latin America. The Asia Pacific region offers large profit margins to the key players operating in the hematology analyzer market. Hence it achieved the fastest growth rate during the forecast period. The major reasons include growing healthcare infrastructure, increasing prevalence of hematological disorders, rising disposable income, presence of domestic companies, and aging population in the region.

In addition, factors such as population growth and economic growth in developing countries such as India and China are also supporting the growth of the hematology analyzer market in Asia. Technological advancements coupled with supportive government investments and funding, especially in developing countries such as India and China, are also expected to contribute to the market growth.

However, the North American market is still the largest market for hematology analyzers. North America is expected to grow at the highest rate. at a CAGR of 6.20% during the forecast period.