release time:2024-01-05 13:47:46

The field of in vitro diagnosis (IVD) plays a crucial role in disease prevention, diagnosis, treatment, and health evaluation by employing samples of blood, body fluids, tissues, and other materials from the human body. These samples are subjected to various tests and calibrations using reagents, kits, and quality control substances. IVD covers a spectrum of disciplines such as biochemistry, genetics, immunology, microbiology, and molecular biology, contributing to comprehensive clinical diagnostic information. This article delves into China's IVD market, offering an in-depth analysis of six major segments: immunodiagnostics, biochemical diagnostics, molecular diagnostics, coagulation diagnostics, microbiological testing, and point-of-care testing (POCT).

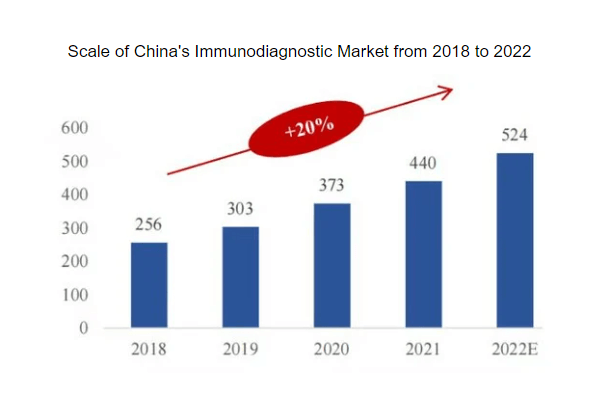

Immunodiagnostics emerges as the most extensive IVD market segment in China, employing immunology-based reactions between antigens and antibodies for qualitative or quantitative diagnosis. With a growing market share, the sector expanded from 29% in 2012 to 36% in 2020. China's immunodiagnostics market size surged from 25.6 billion yuan in 2018 to 44 billion yuan in 2021, driven by an approximate 20% five-year growth rate. The sector's advancement is bolstered by technological progress, product innovation, and a shift towards hierarchical diagnosis and treatment.

Chemiluminescence, enzyme immunoassay, and colloidal gold are integral techniques within immunodiagnostics. Chemiluminescence stands out due to its high sensitivity, specificity, and automation advantages, commanding the largest market share and promising growth. This method's market escalated from 11.93 billion yuan in 2016 to 28.44 billion yuan in 2020, with an anticipated reach of 63.26 billion yuan by 2025. Foreign players such as Roche, Abbott, and Siemens historically dominated, but domestic companies like Snibe, Autobio, and Mindray are asserting themselves through R&D breakthroughs and policy support.

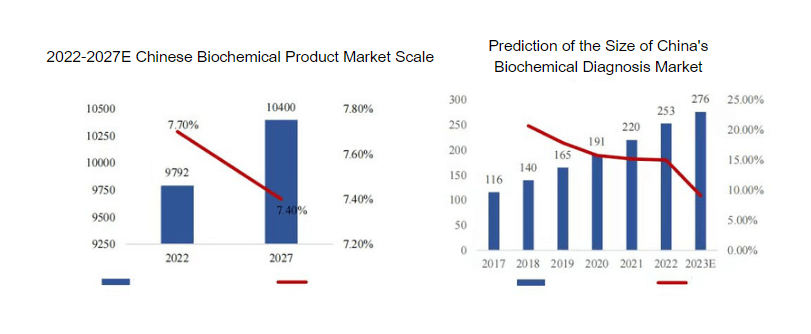

Global biochemical diagnostics, mature and stable, exhibited steady growth. China's market, accounting for 19% of the IVD market, maintains a trajectory of stable expansion, projected to exceed 27 billion yuan in 2023. Local firms primarily focus on reagents while domestic biochemical analyzer manufacturers are on a developmental journey from manual to fully automated instruments. Established players such as Beckman Coulter and Roche remain influential, but domestic vendors like Mindray, MedTech, BSBE and Seamaty are gaining traction, primarily in the low-end market.

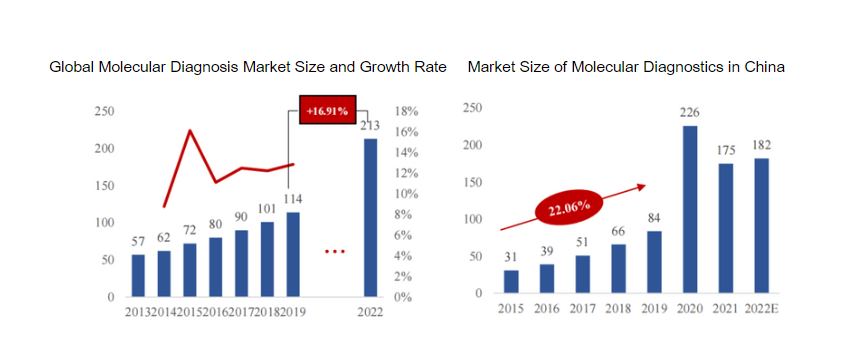

Molecular diagnostics, reliant on molecular biology to diagnose through genetic material analysis, witnessed a substantial boost due to the COVID-19 pandemic. Prior to this, the sector demonstrated steady growth, more than doubling in size from 2013 to 2019. The pandemic accelerated global growth, propelling the market from $11.4 billion in 2019 to $21.3 billion in 2022. China's molecular diagnostics market, although relatively new, exhibited remarkable development with a CAGR of 22.06% from 2015 to 2019. Post-pandemic, growth remains robust due to increased testing infrastructure and downstream opportunities.

Given China's significant burden of cardiovascular diseases, the coagulation diagnosis market is gaining prominence. The sector's size surged from 3.5 billion yuan in 2016 to 7.5 billion yuan in 2020, with projections of continued expansion. Dominated by international players, local companies are entering the market, mainly targeting the low-end sector.

In China's coagulation test market, companies can be divided into three echelons according to market share, the first echelon for foreign brands: Sysmex Corporation, Stago and Worfen, dominating China's market share; the second echelon for a certain share of local companies: Beijing Succeeder, Shanghai Sunbiote, Mindray and Beijing ZONCI; the third echelon consists of other small-scale local enterprises, such as Chengdu Seamaty. Compared with international brands, Chinese enterprises developed coagulation diagnostics late, covering a less comprehensive diagnostic categories, and are still in the R&D accumulation stage.

Microbiology testing, a field with diverse techniques such as traditional methods, gene detection, and mass spectrometry, is witnessing growth due to technological advancements and increasing infectious disease incidences. China, a major consumer of antibiotics, is investing in microbiology testing to control antibiotic misuse. While the sector is still reliant on foreign suppliers, there's room for domestic growth.

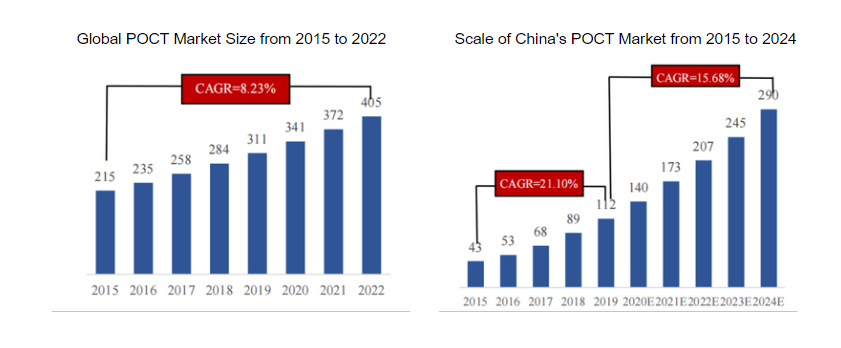

Point-of-care testing (POCT) is transforming diagnostic practices through its convenience and efficiency. China's POCT market is rapidly evolving, from $4.3 billion in 2015 to $11.2 billion in 2019, and is expected to reach 29 billion yuan by 2024. Global giants dominate, but local players are emerging, particularly due to the pandemic-driven demand. POCT is evolving, combining molecular diagnostics with rapid testing, leading the industry's future.

China's in vitro diagnostics market is a mosaic of evolving segments, each contributing to the nation's healthcare landscape. The immunodiagnostics sector leads with significant growth, while biochemical, molecular, and coagulation diagnostics are carving out niches with domestic and global implications. Microbiology testing tackles infectious diseases, and point-of-care testing is reshaping diagnostics for the modern age. As China continues to invest in healthcare infrastructure and R&D, the IVD market's trajectory points towards enhanced patient care, disease management, and overall public health.

2024-12-12

Explore how the Seamaty SG1 Blood Gas Analyzer transforms respiratory care. With its portable design, accurate diagnostics, and user-friendly operation, it’s the perfect solution for healthcare providers managing respiratory diseases in both primary care and emergency settings.

2022-01-05

Clinical biochemical tests allow the study of biochemicals in the human body in disease states and the changes in their indicators. Clinical biochemistry analyzers can be applied not only for routine testing of clinical biochemistry,

2021-09-23

Fully automated biochemistry analyzer is a clinical biochemistry analyzer. It provides clinical biochemistry testing for hospitals at all levels, and is a basic and essential diagnostic instrument in laboratory medicine.