release time:2025-02-25 10:16:44

2024-06-12

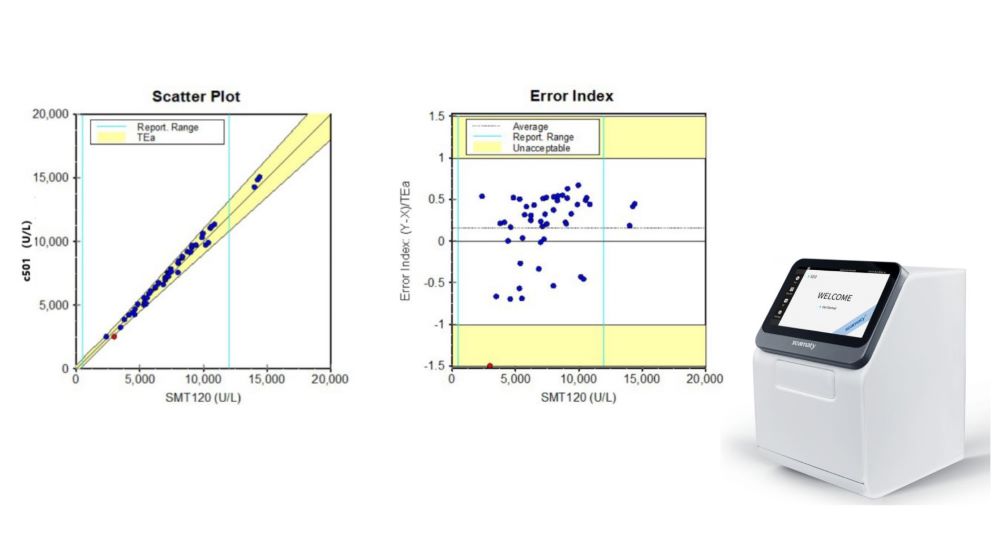

To explore the comparative analysis of cholinesterase detected by seamaty SD1 automatic dry biochemical analyzer and Roche Cobas 6000 c501 automatic biochemical analyzer. To provide reference for the establishment of a simple and reliable cholinesterase determination method.

2022-06-29

An automated analyzer is a machine that automatically performs complex chemical analyses of substances. The machine does this by using a variety of techniques,

2021-10-26

Diet affects a variety of substances in the blood. For example, the concentrations of glucose (GLU), triacylglycerol (TG), ALP and phosphorus. Eating a high-protein diet one day before the blood draw can result in high urea nitrogen (BUN) and uric acid (UA) results. The increase in lipid concentrations in the blood, especially TG, after eating can lead to a milky cloudy serum, which can interfere with biochemical measurements. This may result in high results for bile acids, proteins, calcium and phosphorus. The results of amylase measurements are low.